Heighten’s Accounting Systemisation

As your business grows and its financial transactions become more complex, manual accounting processes become increasingly difficult to manage. That’s when smart business owners start considering implementing accounting systemisation in their business.

Accounting is a critical aspect of running your business. It helps you track and manage financial transactions, ensure compliance with laws and regulations, and provide insights into the financial health of your organisation.

Heighten Accounting Systemisation service supports businesses in the process of automating and streamlining accounting processes using software applications. By doing so, we help you reduce the time and effort required to manage financial transactions, improve accuracy, and gain more insight into your financial performance.

Our expert team at Heighten helps you identify the accounting applications suitable for your industry and business size. Our criteria in selecting any accounting application include features such as automated data entry, account reconciliation, financial reporting, digital dashboards, and tax compliance. We also ensure that the software has the capability to integrate with other applications and provides robust security measures to protect sensitive financial data.

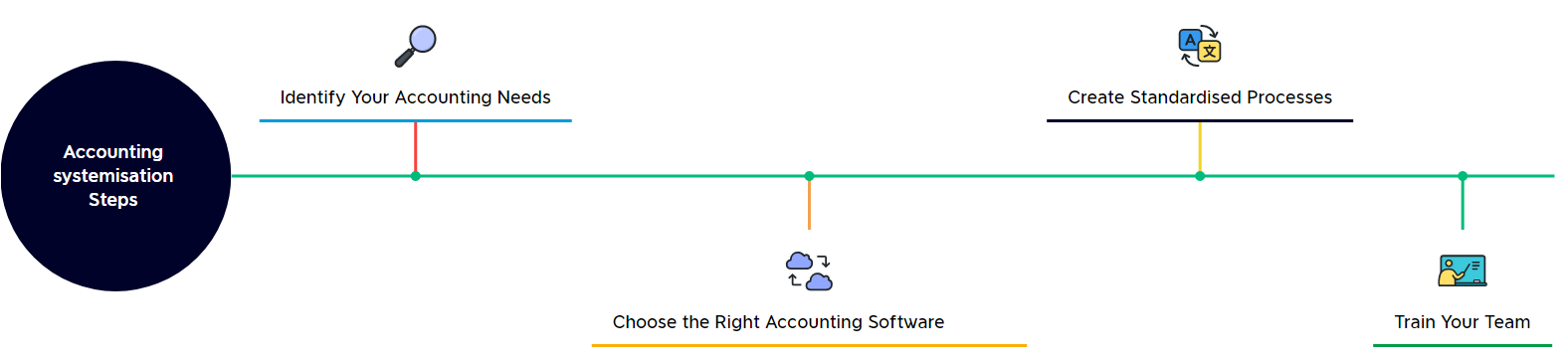

How to implement an Accounting System in your business?

Automated Accounting Systematisation involves creating a standardised process for accounting tasks that can run efficiently with the least involvement. This helps ensure consistency, accuracy, and efficiency in financial management. Here are some key steps to

The first step in systematising your accounting process is identifying your accounting needs such as data input for bookkeeping and financial reports, payroll, expense management, wages, and HMRC payments.

Choosing the right accounting software is crucial to creating an efficient and effective accounting system. There are many options available, each with its own features and benefits. Consider your business’s size and complexity, as well as your budget, when selecting the right software.

Once you’ve identified your accounting needs and chosen the right software, it’s time to create standardised processes for each accounting task. This includes creating a chart of accounts, setting up invoicing and billing procedures, creating a payroll system, and more.

A standardised accounting system is only effective if your team knows how to use it. Ensure that your team has received adequate training on the accounting system. This includes both initial trainings when the system is first implemented and ongoing training to ensure that everyone is up to date on the latest system features and best practices.

Our team of experts can help you in developing your accounting policies and tax-efficient strategies. We have developed relationships with industry leading accounting software providers and have skills to install the applications, standardise the accounting process and train your team to execute the plan.

Why implement an accounting system?

Accounting is a fundamental part of running any business, big or small. It is critical that the accounting firm you work with should understand the automation processes involved in recording, summarising, and analysing financial transactions to help business owners make informed decisions.

We have over 20 years of experience in implementing accounting systems for businesses and are up to date with technological changes. Here are some of the top reasons to work with Heighten team to implement an accounting system in your business:

Increased Efficiency:

Automate routine accounting tasks with our expert team, save time and process financial information quickly to improve your cash flow.

Improved Accuracy:

Reduces the risk of human errors by automation, ensuring accurate data for financial statements, compliance, and critical decision making.

Innovative Insights:

Generate detailed reports and financial statements quickly and easily, gain better insights into financial performance, and make more informed business decisions.

Enhanced Compliance:

Comply with laws and regulations by automating compliance tasks, reducing the risk of errors and penalties.

Effective Collaboration:

Communicate easily on financial matters for the different departments within your business, access real time financial data, and help teams make decisions more quickly.

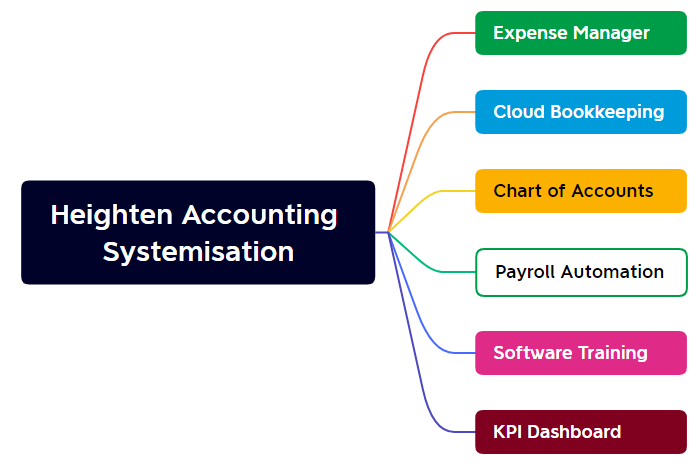

What is included in Heighten’s accounting systemisation?

Heighten business accounting systemisation services are designed to improve the efficiency, accuracy, and overall financial management of your business.

Our process starts with setting up Paper Free Bookkeeping system for your business. Your journey to submit books electronically starts with Heighten Expense Manager. Our accounting experts can run a data quality health check to make sure you are not losing tax savings on your expenses. We link the receipt scanning system to your selected cloud bookkeeping suite and provide you with support, training, and a digital dashboard to view your key performance numbers on one page.

Without a well-organised accounting system, the process of tracking financial information can quickly become overwhelming and error-prone. That’s where Heighten Accounting Systematisation Service comes in.

How does it work?

Heighten Accounting Systematisation involves creating a standardised process for different accounting tasks. This helps ensure consistency, accuracy, and efficiency in financial management.

Here is how systematising your accounting tasks work:

1. Reviewing and organising financial documents

Ensuring that the quality of financial data input is intact by organising expense receipts, invoices, and bank statements, to ensure they are accurately recorded and filed appropriately.

2. Implementing or improving accounting software systems

Making sure you have the right scanning process in place, including introducing and implementing the right Cloud Bookkeeping software to automate processes and streamline financial reporting.

3. Developing and implementing financial policies and procedures

Ensuring that your compliance with relevant regulations and best practices are in place in your business. Personalising Charts of accounts as per your business-specific needs.

4. Streamlining the Payroll process and automating payments

Implementing a system where you and your employee have all payroll information 24/7 through secured portals. Electronic payslips with wage payments are directly sent to your employees and an employer portal is provided for your full control.

5. Providing training and support to your team

Helping you understand different accounting roles in your organisation and providing necessary accounting training to your team members who are responsible for financial record keeping, to ensure they understand how to accurately and efficiently perform their duties.

6. Conducting regular reviews and data audits

Conducting periodic health checks of VAT, Payroll, quality of data input, software updates, and other financial records to identify potential issues or areas for improvement.

7. Developing reports and financial analysis tools

Help business owners make informed decisions based on their financial data.

8. Providing ongoing support and consultation

Assisting you and your team as needed to ensure your financial systems remain effective and efficient over time.

The specific tasks included in a business accounting systemisation service can vary depending on the specific needs of your business. However, at Heighten, we are always committed to improving the financial management of your business and ensuring your decision making team gets accurate and reliable financial information on time.

Businesses we help

We always are on the lookout for new ideas that could help our clients to build an even more happily successful business and achieve business profitability goals.

We help the following businesses and individuals run their businesses more efficiently, with less effort and less stress:

- Limited Companies

- CIS Contractors & Subcontractors

- Small businesses

- Startup Businesses

- Landlords and Property investors

- Sole traders

- Partnerships

- Owner Managed Businesses

- Contractors

- Family Businesses

- Freelancers

- Locum Professionals

- Care Homes

- Marketing Agencies

- IT Service providers

- And Many More

Accounting Systemisation FAQs

Why accounting systemisation is important for a small business?

Having an accounting systemisation is essential for small businesses to accurately track financial data, streamline financial processes, comply with regulatory requirements, and make informed decisions about growth strategies. By implementing an accounting system, small businesses can save time, reduce errors, and focus on growing their business.

How much would be my investment for accounting systemisation for my business?

The cost of implementing accounting systemisation for your business can vary depending on various factors such as the size of your business, the complexity of your accounting processes, the features you need in the system, and the software solution provider you choose.

Some of the costs associated with implementing accounting systemisation for your business can include:

- Software cost: The cost of accounting software, can range from free to hundreds of pounds depending on the features and functionality you require.

- Implementation and customisation cost: The cost of setting up and customising the software to meet the specific needs of your business

- Training cost: The cost of training your team members to use the software effectively.

- Support cost: The cost of ongoing support for the software, such as technical support, software updates, and maintenance.

- Integration cost: The cost of integrating the accounting software with other business systems, such as your inventory management or customer relationship management (CRM) system.

The total investment required for accounting systemisation for your business can range from a few hundred pounds to thousands of pounds or more, depending on the factors mentioned above. It’s important to evaluate the costs and benefits of different solutions and choose the one that best meets your business needs and budget.

How does Heighten support small businesses for accounting systemisation?

We help businesses of all sizes to automate their accounting system. Bringing technology and AI into your accounting system can dramatically reduce your human resources costs and increase the accuracy, efficiency, and profitability of your business.

At Heighten, we start with setting up your Expense Manager and cloud bookkeeping software suite. It comes free or massively reduced price for all of our service plans. This software suite can reduce your bookkeeping cost by at least 30%.

We also help businesses in automating the payroll process. This system can reduce your team admin by 70% or more. All you or your team need to do is update net wages on a cloud-based dashboard and make single lumpsum total wages and HMRC payments to your dedicated bank account, we take care of the rest. We send payslips to your employees, make payments, and provide your team with a portal to control and access real time information.

We also provide training to your team so they can be more productive in your business.

What does an accounting team of a small business consist of?

An accounting team for a small business typically consists of one or a few individuals and independent advisors who are responsible for managing the financial activities of the business. The size and composition of the team will depend on the size and complexity of the business. Here are some key roles that may be part of an accounting team for a small business:

- Bookkeeper: The bookkeeper is responsible for day-to-day financial activities such as recording transactions, reconciling accounts, and generating financial reports. You may have an in-house bookkeeper or delegate it to your accountants.

- Accountancy firm: Accountants can help you in business accounting, tax, and business advisory services. They can also be responsible for more complex financial activities such as financial analysis, tax planning, and other financial support activities.

- Financial Controller: A controller may oversee the accounting team and be responsible for managing the accounting processes, financial reporting, and compliance with regulations.

- CFO: A small business may have a part-time or outsourced CFO who can provide strategic financial advice, help with financial planning and forecasting, and manage financial risks.

- Tax Advisor: You require tax advice for personal and business matters. Your accountants mostly act as your tax advisors. You require to advise on tax efficient remunerations, additional income reporting, and other personal tax planning matters. You may also require specialist tax advice where Chartered Tax advisors can help you in complex tax planning including trusts, estates, and inheritance tax planning.

- Independent Financial Advisors: They can assist you with mortgages, protections, pensions, and other investment matters. They can also have expertise in will writing, inheritance tax planning, trusts, and other wealth management activities.

In a small business, it’s common for one individual to take on multiple roles within the accounting team. For example, the bookkeeper may also be responsible for some accounting tasks that are typically performed by an accountant in a larger organisation. The important thing is to ensure that the accounting team has the skills and knowledge necessary to manage the financial activities of your business effectively.

How can accounting automation and robotic AI help small business

Accounting automation and robotic AI can help small businesses in several ways:

- Increased accuracy: Automation can help to reduce errors and inconsistencies in accounting data by automating repetitive tasks such as data entry and reconciliation.

- Time-saving: by automating routine tasks such as invoice scanning & payments

- Cost savings: By reducing the need for manual labour

- Improved decision-making: By providing real-time financial data and analysis

- Scalability: without having to hire additional staff or incur additional costs

- Compliance: stay compliant with tax and regulatory

- Enhanced data security: by reducing the risk of human error

Overall, accounting automation and robotic AI can help small businesses to streamline their accounting processes, reduce costs, improve accuracy and efficiency, and make informed decisions based on real-time financial data. By embracing automation, small businesses can position themselves for growth and success in an increasingly competitive business environment.