Would you prefer your business profit to stay at the same amount as last year or to be more this year?

If your answer is “yes” then you should regularly use this simple to implement financial analysis and assessment tool. We have provided this three step Profit Reviw guide to help small business owners evaluate and achieve the higher profitability of their company.

This article offers valuable insights and recommendations to improve your business’s financial performance so you can achieve growth and success.

Do I need help from professionals?

I have tried explaining the profit improvement method in this blog in a very simple way, and you should be able to implement it without needing any professional.

However, if you are busy in other exciting tasks and need some extra pairs of hand, you may make your accountants accountable and seek help from them.

Profit review services are typically provided by accounting firms, financial consulting firms, or business advisory services.

These firms have experienced professionals with expertise in financial analysis, accounting, and business consulting. They offer profit review services to businesses of all sizes, including small owner-managed businesses, to help them assess their financial performance, identify areas of improvement, and make informed decisions to enhance profitability.

A Simple Profit Review Tool for your small business

If you are a small owner-managed business in the UK that is looking to improve profitability, then you may want to consider using Heighten’s Simple Profit Improvement guide as follows:

What are the three Profitability Drivers?

Business profitability can be influenced by numerous factors, but in my view, three key factors that have a significant impact on your business profitability are:

- The Quantity of what you sell

- The Average Price you sell it for, and

- Operational Costs

A business ‘profit improvement review’ helps in identifying the key drivers of profitability within the business.

It enables the owner to determine which products, services, or segments are contributing the most to the company’s profits, as well as areas where costs are cutting into profitability.

How to improve your business profitability

You do not necessarily have to go through and analyse the profit and loss, balance sheet, and cashflow statement to gain profitability improvement insights.

You can identify areas of your business’s financial strength, pinpoint potential weaknesses, and overall profitability insight by implementing the following three measures:

- Set a target to increase the quantity of what you sell

- Set a target to increase the average price of your products or services

- Set a goal to reduce the operational costs

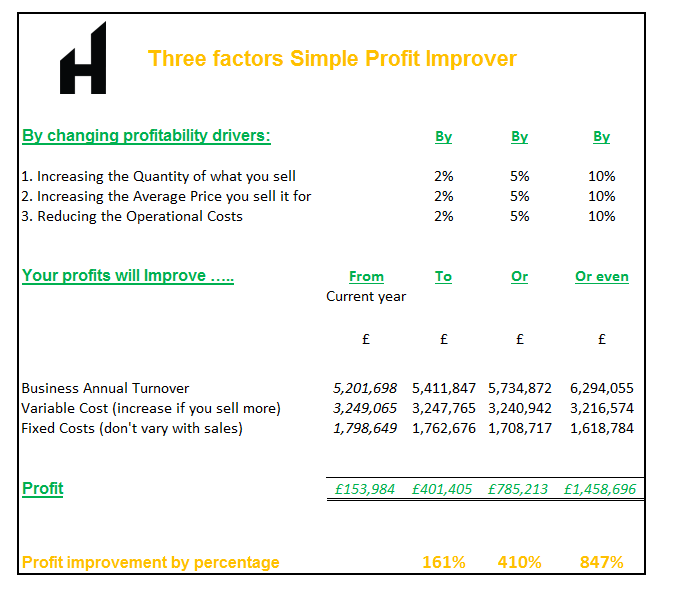

Demonstration:

FREE PROFIT IMPROVEMENT REVIEW REPORT

If you are interested to get a free copy of your profit review and implimentation plan report, please complet the form below (choose other from drop down and mention ‘Profit Review Report’):

Business profitability can be influenced by numerous factors, but these three key factors have a significant impact:

1. Revenue and Sales Volume

Revenue generated from sales is a fundamental driver of business profitability. Several factors can impact revenue and sales volume:

a. Market Demand

The level of demand for a business’s products or services in the market affects its ability to generate sales. Understanding customer needs and market trends can help businesses align their offerings with demand.

b. Pricing Strategy

Setting the right price for products or services is critical. Pricing too low may lead to reduced profitability, while pricing too high could result in lower sales volume. Striking a balance between pricing and value proposition is essential.

c. Sales and Marketing Effectiveness

Efficient sales and marketing strategies can lead to increased sales and improved profitability. Investing in marketing initiatives that resonate with the target audience can boost revenue.

2. Cost Structure

The cost structure of a business plays a crucial role in determining its profitability. There are two primary types of costs that can affect a company’s bottom line:

a. Fixed Costs

These are costs that remain constant regardless of the level of production or sales. Examples include rent, salaries, insurance premiums, and certain administrative expenses. High fixed costs can put pressure on profitability, especially if sales volume is low.

b. Variable Costs:

Variable costs are directly related to the level of production or sales. Examples include raw materials, direct labor costs, and commissions. Effective cost management and negotiating with suppliers can help control variable costs and improve profitability.

3. Operational Efficiency

The efficiency and effectiveness of a business’s operations have a direct impact on its profitability. Several aspects influence operational efficiency:

a. Productivity

Ensuring that employees are productive and well-utilized can lead to higher output with lower costs.

b. Supply Chain Management

A streamlined and efficient supply chain can help reduce costs and improve production processes.

c. Technology and Automation

Investing in technology and automation can enhance efficiency, reduce errors, and save time and resources.

d. Inventory Management

Proper inventory management can prevent overstocking or stockouts, leading to cost savings and improved cash flow.

To achieve and maintain profitability, businesses must carefully manage these factors and continually assess their operations to identify areas for improvement.

Strategic decision-making, cost control, revenue growth strategies, and operational efficiency play vital roles in sustaining profitability in a competitive business environment.

The Role of an Accountant in Improving Business Profitability

The role of an accountant in improving business profitability is multifaceted and crucial to the financial success of the company. Accountants bring their financial expertise and analytical skills to help businesses optimise their financial operations and make informed decisions that positively impact profitability.

Here are some key aspects of the accountant’s role in this context:

- Accountability partnership

- Financial Analysis and Reporting

- Cost Management

- Budgeting and Forecasting

- Financial Efficiency and Compliance

- Tax Planning and Optimisation

- Financial Decision Support

- Cash Flow Management

- Performance Metrics and KPIs

- Business Analysis and Advisory

- Financial Controls

In summary, the role of an accountant in improving business profitability goes beyond bookkeeping and financial reporting.

They are strategic partners, working closely with management to optimise financial performance, identify opportunities for growth, and strengthen the business’ financial position for long-term success.

Heighten Accountants can help you with your business profit growth following the profit review method. Get in touch with us to learn more by filling out the form below!

Profit Review FAQs

How can I assess the financial health of my business?

Analysing various financial components of your company’s finances to acquire insights into its overall performance and stability is an essential step in determining its financial health. You may measure your company’s financial health by following these crucial steps:

- Review Financial Statements

- Calculate Key Financial Ratios

- Compare Performance Over Time

- Benchmark Against Industry Standards

- Assess Working Capital Management

- Consider Growth and Investment Strategies

- Evaluate your business’s growth strategies and investments

- Monitor Debt and Credit Management

- Conduct Sensitivity Analysis

- Seek Professional Assistance

Engage with an accountant or financial advisor to conduct a comprehensive financial health assessment and provide expert recommendations.

Regularly assessing your business’s financial health allows you to identify strengths and weaknesses, make informed decisions, and take proactive measures to ensure its long-term success and sustainability.

What are the key factors to consider when managing cash flow for improved profitability?

Managing cash flow effectively is crucial for improved profitability and the overall financial health of a business. Here are key factors to consider when managing cash flow to enhance profitability:

- Cash Flow Forecasting

- Accounts Receivable Management

- Accounts Payable Management

- Inventory Management

- Control Operating Expenses

- Capital Expenditure Planning

- Financing Options

- Cash Reserves

- Working Capital Management

- Scenario Planning

By effectively managing cash flow and considering these key factors, businesses can enhance their profitability, reduce financial stress, and position themselves for sustainable growth and success. Regular monitoring and adjustments to cash flow management strategies are essential to ensure the continued health of the business.

How can I minimise my tax liabilities and take advantage of tax incentives?

You require careful planning and adherence to relevant tax regulations to minimise tax liabilities and take advantage of tax incentives. Here are some strategies to help you achieve these goals:

- Work with Tax Professionals

- Choose the Right Business Structure

- Expenses Management

- Capital Expenditures

- Research Tax Incentives

- Compliance and Timely Filing

- International Tax Planning

- Losses Management

Tax laws are subject to change, staying informed about updates and seeking professional advice regularly is essential to maintain tax efficiency and compliance. Implementing these strategies can help you minimise tax liabilities and maximise tax benefits, allowing your business to retain more of its earnings for growth and investment.

What are some common financial mistakes businesses make that hinder profitability?

Here are time five common mistakes that can cast your business:

- Poor Expense Management

- Inaccurate Pricing Strategies

- Inadequate Credit Control

- Ignoring Tax Planning

- Failure to Monitor Key Metrics

To avoid these financial mistakes and enhance profitability, businesses should prioritise financial planning, implement efficient expense and inventory management strategies, invest in credit control, maintain accurate financial records, and seek professional financial advice when needed. Consistently reviewing financial performance and making data-driven decisions are critical for achieving long-term financial success.

Leave a Reply